A T-account is an invaluable element of bookkeeping that enables one to keep clear track of the debits and credits for any business. By scaling the process down into these manageable accounts, financial transactions can be organized with accuracy. In this article, we will give clearer insight into T-accounts, their importance, and the procedure of posting transactions to them.

An Introduction to T-Accounts

The classic T-accounts are an intuitive way for businesses to clearly view their financial accounts and track any transactions – a major asset of the double-entry accounting system. This simple framework can be tapped into for a quick and organized record of company accounts, making it an irreplaceable tool in the world of accounting.

A “T” in a T-account implies ‘transaction’, and is a way to describe the flow of credit and debit transactions for an account. This concept consists of two columns, one on each side to indicate debits and credits respectively. Every activity is carefully recorded under either one of these elements.

Exploring the Significance of T-Accounts

With the help of t-accounts, bookkeepers can swiftly register financial transactions. It provides an insight into the double-entry accounting system, which serves as the basis of current financial accounting. This visualization offers an effective way of correctly keeping financial records.

Through the use of T-accounts, bookkeepers can efficiently catalog and monitor transactions as they occur, allowing them to closely evaluate any alterations to the business’s finances. This streamlines the bookkeeping process and ensures that all entries are up-to-date and accurate.

By employing T-accounts, businesses can ascertain any inconsistencies in their own books and the information generated by their customers. It is a vital step towards guaranteeing the accuracy of the establishment’s financial documents.

Recording T-Accounts Transactions – A Detailed Guide

Recording transactions into designated T-accounts is relatively straightforward. To complete the task, the bookkeeper must merely insert the amount of the respective transaction into the allocated column.

The bookkeeper would register a $100 debit and a $100 credit if the business were to purchase an item, signifying the appropriation of the product. This led to a reduction of the business’s cash and an increment in their inventory account.

The rule with bookkeeping is firm – debits and credits must remain in equilibrium. Put simply, the sum of the debits must be matched by the total amount of credits. Should they be out of balance, it falls to the bookkeeper to investigate the reason for the misalignment.

Keeping track of accounts is an integral aspect of bookkeeping, and one simple method to do so is by logging transactions to T-accounts. This type of bookkeeping allows for the swift and accurate registration of financial movements, facilitating faster identification if mismatches should arise between the accounts of a business and the data reported by their customers.

Recording finances on T-accounts is integral to the accounting process and the system of double entry. This basic process demands that all financial transactions be documented and tracked, and is necessary to compile reliable financial statements. A simple operation, it can be applicable to both businesses and individuals alike.

Accounting keeps an eagle eye on all financial transactions through the use of a T-account. This visual method of record-keeping helps to securely store pertinent information regarding debit and credit sides, plus the account’s starting, current, and ending balances. Whether it’s sales, purchases, or expenses, all can be accurately tracked in T-accounts.

Before any transaction can be correctly recorded in a T-account, it is important to establish its type. The source document, such as an invoice or receipt, can help one determine the transaction type. The next step is to choose the right T-account from the chart of accounts. Allocating the transaction to the correct T-account guarantees accuracy in financial statements.

After the T-account has been chosen, the next step is identifying the sum of the transaction. This is accomplished by taking a glance at the source document or bill. When the magnitude has been decided upon, it is time to add the transaction to the T-account. This is completed by noting the amount of the transaction as either a debit or credit. Note that debits should never be entered on the right side of a T-account; associated summits should only appear on the left side, whereas credits must always be recorded on the opposite side.

Prior to the transaction being posted to the T-account, updating the beginning balance, current balance, and ending balance is essential. This initial balance is the amount present in the account just moments before the transaction took place. Subsequently, once the transaction is recorded, we compute its current balance as a gauge of what lies within the T-account at that precise point in time. Ultimately, to finish this process off, we must update the total ending balance which encompasses all operations that have been done within the designated period.

After a transaction is submitted to the T-account, it is prudent to inspect the details thoroughly. This involves a close examination of the records, cross-referencing to check the entered figures against those on the source documents. Any irregularities should be pinpointed and adjusted accordingly right away.

The double entry system of accounting calls for the recording and tracking of all monetary exchanges, for which posting to T-accounts serves as an efficient approach. This basic and straightforward method is applicable to individuals as well as organizations, with the instructions above offering a productive guide to manage transactions and preserve precision in reports.

Related Product

Y Post

Length:1.35m,1.5m,1.65m,1.8m,2.4m etc Weight:1.58kgs,1.86kgs,1.9kgs,2.04kgs/m etc Surface:painted, Hot dip galvanized, No paint Usage:farm fencing,garden fencing Packing:400pcs/pal […]

Nail Stake

Product information: Description Unit Pallet Weight(kg) 3/4″x12″ 10pcs/box 150boxes/pallet 0.6200 3/4″x18″ 10pcs/box 100boxes/pallet 0.9250 3/4″x24 […]

Israel Y Post

Y post with teeth provides the most reliable way of fencing wire attachment by threading the wire through the holds along the post, gripping the wire with is specially designed tee […]

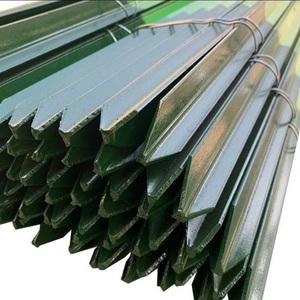

Studded T Post

material: rail steel weight: 0.85,0.95,1.25,1.33lbs/ft etc length: 5′-10′ etc surface: painted with spade,painted no spade,unpainted with spade,unpainted without spade,hot-dipped g […]

T Post Clip

These heavy duty T-post clips fit standard size 1.25 and 1.33 lb. studded T-posts. Manufactured from 11-1/2 gauge wire that is Hot-dipped galvanized, these clips are designed for f […]

U Post

Heavy Duty Garden U Shaped Steel Fence Post With Spade Shape: U shape, with or without spade Material: low carbon steel, rail steel, etc. Surface: Powder coated Advantage: Easily A […]

T Post

Material: rail steel Weight: 0.85,0.95,1.25,1.33lbs/ft etc Length: 5′-10′ etc Surface: painted with spade,painted no spade,unpainted with spade,unpainted without spade,hot-dipped g […]

Y Post Cap

Y Posts Caps is also called safety cap or Star picket caps. It used for Y star picket . It can cover sharp edges of Y posts. Type Size(L x W X H) Thickness Weight Round 57x57x60mm […]

Post time: 2023-07-26